Trade With Me

Our 10-month professional online training program helps you become an independent thinker

You Asked For TWM...

I'm Ali Moin-Afshari. I've been a professional price action trader for over a decade.

Following my live trading sessions in the 2022 and 2024 Orlando Workshops, many traders and my own students reached out and told me they learned more in those live trading sessions than months of studying. They asked me for more live trading.

However, I knew a trading room was not the answer. We needed a structured program that builds up traders' skills one step at a time. I designed Trade With Me to be that program.

Q&A session with Dr. Al Brooks at the Orlando Workshop

During the Orlando workshops, we had two live trading days, so I had to trade whatever the market gave me. It is quite limiting when you want to demonstrate good trading because the market might not accommodate the concept I want to teach. For example, I want to teach breakouts, but the market is in a tight trading range where breakouts fail and reverse, and the day has a small range as a result.

With TWM, we can estimate when to schedule our live trading session for the best or most opportune outcome, and if the market does not give us what we want, we might schedule a substitute day. A live international event does not give you that flexibility.

Furthermore, I received a lot of emails from traders who said they'd like to attend, but won't be able to because of visa and travel restrictions to the United States. Others said the cost is prohibitive, and still others who were not able to get time off work. A virtual event gets around most of these limitations and will make it accessible to many more traders around the world. It is a big incentive for my team and I to be able to help as many traders as we can.

Ali Moin-Afshari

Founder, Trade With Me Program

Point of view from my live trading desk at the Orlando Workshop

Here is an interesting experience to share. Ask any trader and they will tell you they prefer trading from their home office because it's the most comfortable. While trading on the stage in Orlando, the first 10 to 15 minutes was different than the rest of the trading day. During those first few minutes I was conscious of the new environment, but as soon as the trading began, analyzing the chart began absorbing my attention so much that I forgot where I was and I was trading as usual, except periodically when I would look beyond my screen at the audience and remember I am not at my trading desk.

I later realized that day trading is like Zen. You get absorbed into your work and forget everything else. Professional traders find trading calm and peaceful because it detaches them from everything else, and since they are in control of themselves, their trading time becomes a relaxing time when they don't have to think about anything else.

At one of those moments, I grabbed my cell phone and took the above photo. It shows my point of view when I looked past my screens. It is amazing how your training kicks in and detaches you from the surroundings.

What is TWM?

TWM is a 10-month hands-on training program for advanced beginners all the way to advanced traders who want to learn by practicing in a live trading environment.

A decade ago, as a developing trader, I felt the need for watching professional traders day trade live. At the time, I used to attend trading rooms, but trading rooms are not structured. A trader trades all sorts of things and at the end of the session I was left thinking "OK, so what do I do now?"

I decided creating a structured program that presents concepts one at a time from simple to complex and builds new skills on top of the previously learned concepts in a progressive manner, is the answer.

TWM is meant for traders who are not absolute beginners. They know the concepts but also feel the need for more advanced instruction to fill the gaps. TWM is also for traders who want live trading experience by watching how a trader makes decisions and executes on them.

The live trading sessions are organized based on the TWM syllabus. In each trading event, we focus mainly on trading the concepts already taught.

Why Traders Need TWM

If you're struggling with any of these challenges, you're not alone. Most developing traders face these exact issues every day.

Can't Decide What to Do on Each Bar

"I know I should buy a bull breakout, but I don't know how to implement it." Sound familiar? Most traders freeze when faced with real-time decisions.

Don't Know How to Manage Open Positions

- • Which moves against you should be ignored?

- • Which ones mean immediate exit?

- • How much drawdown is acceptable with limit orders?

- • How to scale-in to increase winning probability?

Constant Trading Stress & Fear

Living in fear that the next trade will wipe out your account. Unable to utilize your full trading capital, constantly underperforming due to psychological pressure.

Can't Read Charts Accurately

- • Lack of clarity on chart patterns - are they complete or not?

- • Inability to count legs properly and accurately

- • Not knowing if a move has gone far enough

- • Unclear what "strong" means in different contexts

- • Unable to correctly interpret chart context

Starting with Swing Trading (Big Mistake)

Most beginners want to swing trade, but it's the LAST thing you should do as a day trader due to its complexities and high failure rate.

How TWM Transforms Your Trading

Ali's revolutionary approach addresses every challenge you face, taking you from confusion to confidence.

A New Dimension of Understanding

Ali's teaching goes beyond what you've learned from books and other courses. He introduces another dimension of market understanding that addresses all your trading challenges and more.

From Basics to Advanced Scalping

TWM takes you on a complete journey. We teach each concept, show you how it's implemented in live markets, and let you watch over Ali's shoulder while asking questions in real-time.

Build Your Trading Arsenal

Get a plethora of concepts to trade, so you can choose what's right for you now and expand your repertoire as you advance. No time wasted on patterns - you'll understand WHY they look the way they do, when to expect what, and why.

The Structure You Need to Succeed

Time spent learning in a structured way is a critical success factor. TWM provides the exact structure you need without wasting time. Stay accountable with lessons presented in timely, manageable chunks - no need to stay disciplined, just follow along and complete the work.

Join hundreds of traders who've transformed their results

How TWM Works

Open Enrollment — Start Learning Today

When you join TWM, here's what you get immediately:

TRADING SESSIONS

One full trading session with

Ali Moin-Afshari trading live

EDUCATION ACCESS

All available modules

(6+ hours each)

Q&A SESSIONS

Post-session support with

Brad Wolff and James Regan

Your 10-month program starts as soon as you join:

Full access to all available educational modules

10 monthly live trading sessions with Ali (beginning the month you join)

No cohorts, no waiting — join anytime and get the complete program

See the Depth of Our Educational Content

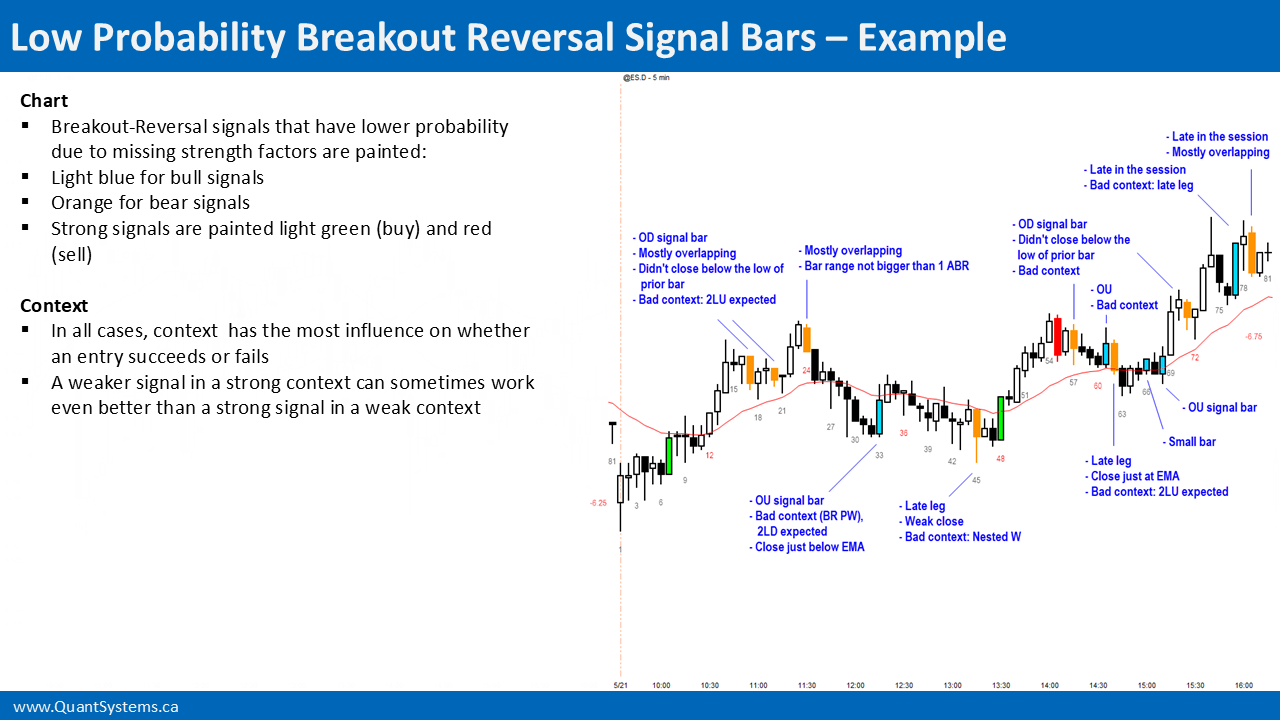

Every module includes detailed instruction, visual examples, and real-world context. Here's an example from Module 1:

Click to view full size

See the complete curriculum breakdown below

View Complete SyllabusThe TWM Curriculum - 10 Learning Modules

Each module covers one core principle of market behavior through detailed video instruction. Watch Ali apply these concepts live during your monthly trading sessions, followed by Q&A with our coaching team.

Basic Concepts

- •Principles of bar structures

- •Bars, bar types, and formations

- •Market behavior: bar context classification

- •Buy/Sell zones of bars

- •Using buy/sell zones to structure new entries

- •Time of day: the significance time for day traders

- •Why scalping is more appropriate for beginners

- •Simple math of scalping vs swing trading

- •Why many small trades are better than a few big swings

- •Using AMA_Breakouts_PB indicator

- •How to study to become a competent trader

Principles of Price Structure: Breakouts

- •Breakouts

- •Implied breakouts

- •Unit of price structure: Spikes or simple legs

- •The breakout process

- •Assessing breakout strength (the 10+2 factors)

- •Counting legs

- •The fractal nature of price action

- •The basic price structure: Bulls and bear structural units

- •Failed structural units (everything fails)

- •The role of context

- •Overlap

Principles of Market Behavior - Part 1

- •Principle of Event-Response

- •Inter- vs. Intra-bar energy

- •Principle of Market Control

- •Type 1 market control

- •Type 2 market control

- •Type 3 market control

- •Principle of Cyclical Volatility

- •Understanding volatility regimes

- •Intraday volatility regime shifts

- •Principle of Ambiguity

Principles of Market Behavior - Part 2

- •Principle of Inertia

- •Market tempo

- •Types of market tempo

- •Probabilities of market tempo

- •The First Attempt Principle

- •Second and later attempts

- •Tests

- •The Two-Test Principle

- •H1/L1 and H2/L2 setups

- •Implied and actual tests

Principles of Market Behavior - Part 3

- •Principle of Symmetry and Proportion

- •Symmetry and proportion possibilities

- •Symmetry and proportion are rarely exact

- •Symmetrical but disproportionate

- •Symmetrical range (MM) but disproportionate

- •Asymmetrical but (almost) proportionate

- •Asymmetrical and disproportionate

- •Principle of Two Sides

- •What happened to the market-maker?

- •Market-maker's probabilities (buy- and sell-side examples)

Principles of Day Structure

- •Principle of Predictable Day Structure

- •Types of day structures

- •Probabilities of seeing different Day Structures

- •Dominant feature of the day

- •Change of behavior

- •Relationship between intraday and daily charts

- •Role of overnight and pre-market trading

- •Opening gaps

- •Opening range

Trading Ranges and Multi-Push Patterns

- •Trading ranges

- •Legs in trends vs. legs in trading ranges

- •Buy/Sell zones of trading ranges

- •Wedges

- •Parabolic wedges

- •Most wedges are complex two-legged structures

- •Triangles

- •Expanding triangles

- •Nested patterns

- •H4/L4 Channels

Reversals

- •Characteristics of a strong reversal signal

- •Reversals often form in trading ranges (TR is prerequisite)

- •Secret handshakes preceding reversals

- •First and second reversals

- •The i1R concept

- •Context: reliable reversals need good context

- •Estimating end of the trend using the Principle of Inertia: counting reversal signals

- •Reversal probabilities of bar 1

- •Reversal probabilities of strong legs on the open

- •Minor and major reversals

Traps and Failures

- •A successful breakout is a trap: failure to pullback

- •Strong signal failures

- •Failure of a failure (FOF)

- •Point-of-Clarity + FT = Trap!

- •The market-maker trade

- •The failed market-maker trade

- •The successful first attempt trap

- •One-legged trading ranges: breakout of a leg in TR

- •Second leg traps in trading ranges

Scalping

- •Understanding BOM (Breakout Mode)

- •Understanding the opportunity cost of not scalping

- •Limit order vs. stop/market order entries for scalping

- •Stop/Market order scalps

- •Advantages of limit order entries

- •Adjusting trading style to market cycle

- •Adjusting trading style to day structure

- •Being the market-maker

- •Trading against trapped traders

- •Hunting for stops

- •Front running reversals

Ready to master these principles with live trading guidance?

Sign Up NowWhat is Expected of You

We want you to become an independent thinker so that you can trade on your own without any external help. This program is designed to help you achieve it, but you have to do your part, too.

Prepare

- •Watch video lessons prior to the live trading day

- •Study the video: pause, think, take notes, and review

- •Look at other charts and try to identify and explain the concepts you learned from the video lessons

Participate

- •Participate in live trading sessions but do not trade during the session

- •Engage actively by trying to predict what will happen next and what trades will be taken and how they will be managed

- •Try to stay a step ahead. Take notes and write down your questions

Engage

- •Ask your questions during the Q&A session

- •We all learn better in a group

- •Listen and think about the questions others ask. Take notes

Practice

- •During the remaining days of the month, practice implementing what you learned

- •Focus on clean execution and skill building on one or two of the concepts you like the most

- •Don't do anything else, just try to master correct analysis and identification of the one or two concepts that are the focus of the month, and their clear (mistake-free) execution

Follow this proven process every month to build professional-grade trading skills

Ready to Join TWM?

Start your journey to becoming a professional trader with our 10-month program

Frequently Asked Questions

Everything you need to know about the Trade With Me program